Budgeting, Saving hacks

4 tips to get your finances back on track after vacation

Plane tickets, ice cream for the kids, rosé for the adults, siesta snacks, and souvenirs. When you’re in vacation mode, there’s plenty of stuff you can spend your money on. And once you first start spending money, it’s easy to just let loose and keep on swiping that credit card - after all, another piña colada won’t hurt, right?

But before you know it, vacation time is over, and it’s back to everyday life. And that’s when the financial reality kicks in, and you realise just how much you went over your vacation budget.

Does this mean you’ll have to live on bread and water for the next couple of months? Nope, not at all. With a little overview of your finances and maybe a few changes here and there, you’ll be back on top of your money in no time.

So take a seat in your favourite chair and read our four best tips on how to get your finances back on track.

1. Face the numbers

Out of sight, out of mind. We don’t reeeeally want to check our bank account after a long, dreamy and expensive vacation.

But actually, you’re better off by facing the numbers head-on.

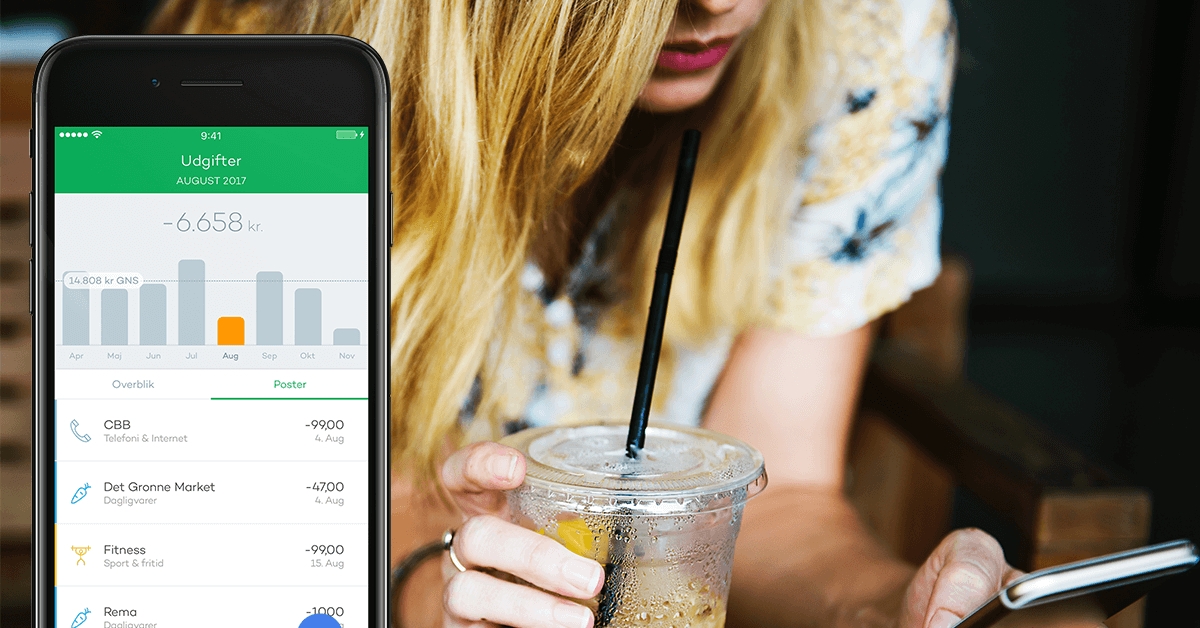

Log into your internet bank or Spiir account and go through your transactions regularly. When you’re aware of how much money you have in your accounts, you’ll have a much better foundation for changing your financial situation after a vacation.

2. Discover what’s eating up your money

Being back in your everyday life and habits is the perfect time to start figuring out where your money goes each month. On a day-to-day basis, you might not get the full picture of how much money you spend when you swipe your credit card. And your online bank rarely offers a great overview of your exact spending.

So ditch the online bank and log in to your Spiir app. The app offers you a detailed and user-friendly overview of your money by categorising all your transactions in a smart and easy way. Every time you spend money, it will automatically keep track of it. Cool, right?

Maybe you’ll realise that you spend twice as much money on groceries than you thought. Or discover that you’re paying big bucks for a gym membership you only used a few times the last six months.

Once you have an overview of your spending, you can start to think about how you want to prioritize your money. But how? Read along to get the answer.

3. Do a financial service check

So, about that gym membership that you’re not using… By cancelling your membership, you’ll be able to save a lot of money in the long run. The same goes for your other fixed costs. The trick is to go through your bills one by one and see if you really need all the things you’re paying for or perhaps you can get a cheaper deal:

-

Can you negotiate a lower rate of interest on your bank loan or mortgage?

-

Are you happy with the price of your insurance or can you get the same insurance at a lower rate somewhere else?

-

Are you on the cheapest and best phone plan?

-

Are you using all of the streaming services you’re subscribing to or could you cancel a few of them?

-

Are you paying for a credit card that’s actually just laying in a drawer collecting dust?

By performing a service check on your fixed costs, you’ll likely detect one or two places where you can take action, cut expenses, and save money.

4. 10 golden rules to make room for your wishes

Enough with the fixed costs. Let’s have a look at your daily spending. The fun money category, if you like. Often you can cut back on a lot of unnecessary expenses and use the extra money you save on the things that matter to you.

Enough with the fixed costs. Let’s have a look at your daily spending. The fun money category, if you like. Often you can cut back on a lot of unnecessary expenses and use the extra money you save on the things that matter to you.

1. More money in your pockets? Cut down on impulse buying Avoid bargains, gum by the cashier, and other things in the supermarket that are not on your grocery list. Easy, peasy, you’ve already made more room in your budget!

2. Find products with a low price per kilo By going after food products that gives you good value for your money, you’ll be able to save tons on your grocery bill. Great examples are beans, carrots, flour, and rice.

3. Write down your shopping wishes Categorise your wishes into nice-to-have or need-to-have. Do you really need those new sneakers or would they just be nice to have? This simple shopping tactic makes it easier for you to prioritize your money on the things you really want.

4. Fast food for half the price

Craving those delicious cheeseburgers with fries on the side? Cooking your own greasy Sunday meals will save you a lot of money instead of calling your favorite burger joint each time you have the cravings for fast food.

5. Car-pooling is the way! Is your colleague driving the same way as you every morning? Hook each other up with your own car-pooling system. Not only will you have company, but you’ll also save money on gas, service checks, and CO2. What’s not to like?

6. Seek out the discounts Are you a student? A senior? Does your union give you any membership benefits? Does your workplace offer discounts? Seek out the discounts that are available to you and take advantage of them!

7. Tax breaks? Did you know that there are plenty of things you can write off? For example, if you donate money for charity, you can get tax benefits for it. More tax breaks mean more money for you – ka-ching!

8. Half off dinners at restaurants Want to impress your friends with dinner at a fancy restaurant? Without emptying your bank account? Look up restaurant deals online that give you more bang for your bucks. Bon appétit.

9. Negotiate lower prices - wherever, whenever Get yourself into bargain hunting and negotiate lower prices - if you dare to 😉 There’s lots of money to be saved this way!

10. Lunch box instead of the cafeteria Save tons of money by preparing your lunch meals instead of running to the cafeteria for ‘today’s special’. Your wallet and waistline will thank you.

That’s all! We hope that these four tricks can help you get your money back on track.

Releated Posts

Saving hacks, Spending habits

What makes Spiir special? 9 features that have helped +400.000 people manage their finances

What makes Spiir special? Read about our 9 unique features, which make it easier for you to master your finances.

Big news: Spiir, a part of Aiia A/S, is joining Mastercard

Big news! Spiir, a part of Aiia A/S, is joining Mastercard. Read more about it here 🥳

Student life, Budgeting, Spending habits

23-year-old shares financial tips on Instagram: “We don’t talk enough about money”

Meet Miriam. The young woman who wants to change how we talk about money 💰