Student life, Budgeting, Spending habits

23-year-old shares financial tips on Instagram: “We don’t talk enough about money”

“I think we talk about money and finances in a boring way. If you mention “budget” to someone who’s 19 years old, I don’t think they will associate it with something fun or easy.”

Meet Miriam Faranso.

The young woman from Norway behind the popular Instagram profile Okonomi_studenten – a profile that helps students and young people get more out of their money by sharing financial tips, saving advice and talking about money in a way that’s easy to understand for everyone.

We sat down with Miriam to talk about why she started the Instagram profile, what she thinks is wrong with the way we talk about finances today and how big a part our habits play when it comes to spending money.

Let’s see what she said👇

”Before I started studying business a couple of years ago, I thought that managing personal finances were very difficult to understand. When I was about 17 years old, I started working, and I remember that I thought taxes were very challenging to figure out. At that time, I searched on Instagram to find accounts about personal finances that focused on students – none existed at that time.

This February was my last year on my bachelor’s degree, and throughout the year, I had helped some friends with personal finances and questions about taxes. So, I just decided to create “@okonomi_studenten” and help more people with questions about personal finances. Essentially, I made the account I needed a couple of years ago,” says Miriam.

Big success on Instagram

And it looks like she’s not the only one who loves finding ways to cut expenses and save money. So far, she’s received a ton of positive feedback from people who follow her account on Instagram:

“I’ve received so many nice messages from people who follow my account, and it seems like people love the idea! Especially students have reached out to me and told me that my account has helped them to be more aware of how they spend their money.

I’ve also seen that a lot of people have used my tips on Instagram because they tend to send me messages and explain that the tips were very good. That means so much to me!” Miriam explains.

Personal finance shouldn’t be boring

When Miriam shares her tips, it’s important for her to do it in a simple and understandable way to avoid the usual boring way we talk about personal finance:

“We have to start talking about it positively and explain to people that you can start budgeting and spend money on things you like at the same time. A lot of students my age think that budgeting can be complicated because they don’t know how to set it up and how much money they should spend on different things,” explains Miriam and continues:

“I also think we don’t talk enough about money. I went through 13 years in school, and only talked about money a couple of hours during some math classes. That isn’t enough! Young people in particular need to understand the value of money at a young age.”

“Can I stop doing this and still be motivated and happy?”

When most of us think about personal finance and money, we often tend to think about it in terms of numbers. But if you ask Miriam, money is not just a bunch of numbers on your account – it’s more a question of habits:

“Habits play a big role when it comes to our finances. If you don’t think about your habits and what you spend your money on, it’ll most likely be hard for you to save money or build a healthy relationship with your finances,” says Miriam and continues:

“Last week, I recommended my followers on Instagram to think about their habits and try to figure out which habits cost them a lot of unnecessary money.

I used myself as an example: I spend a lot of money on campus when I’m very stressed and don’t bring food with me, so I tend to buy a lot of food at the student cafeterias. I told my followers that this will be my challenge this semester. I think I got 30 replies from them saying that they had many habits they wanted to quit, i.e. stop smoking, stop buying fast food, or stop online shopping.

What is important here, is to think about the habits we spend money on just because we are lazy. I would never tell someone to quit buying coffee mocha each Friday if I knew this motivated them to study – but I would recommend my friends to borrow books from a library instead of buying them brand new for a semester. Before quitting a habit ask yourself this question “can I stop doing this and still be motivated and happy?”

Trying the Spiir app

During the last couple of weeks, Miriam has tried our Spiir app to see if it could help her get an easy overview of her finances. And her verdict is crystal clear:

“I simply love Spiir! The app is so easy to use, and it gives you a great overview of your finances. What I like the most is that you don’t have to change your bank or get a new VISA card to use the app. This makes it so much easier to start using Spiir. Spiir also categorises transactions for you and allows you to change the names of the categories – this makes it very easy to have a solid control!”

Especially one feature from the Spiir app caught Miriam’s attention:

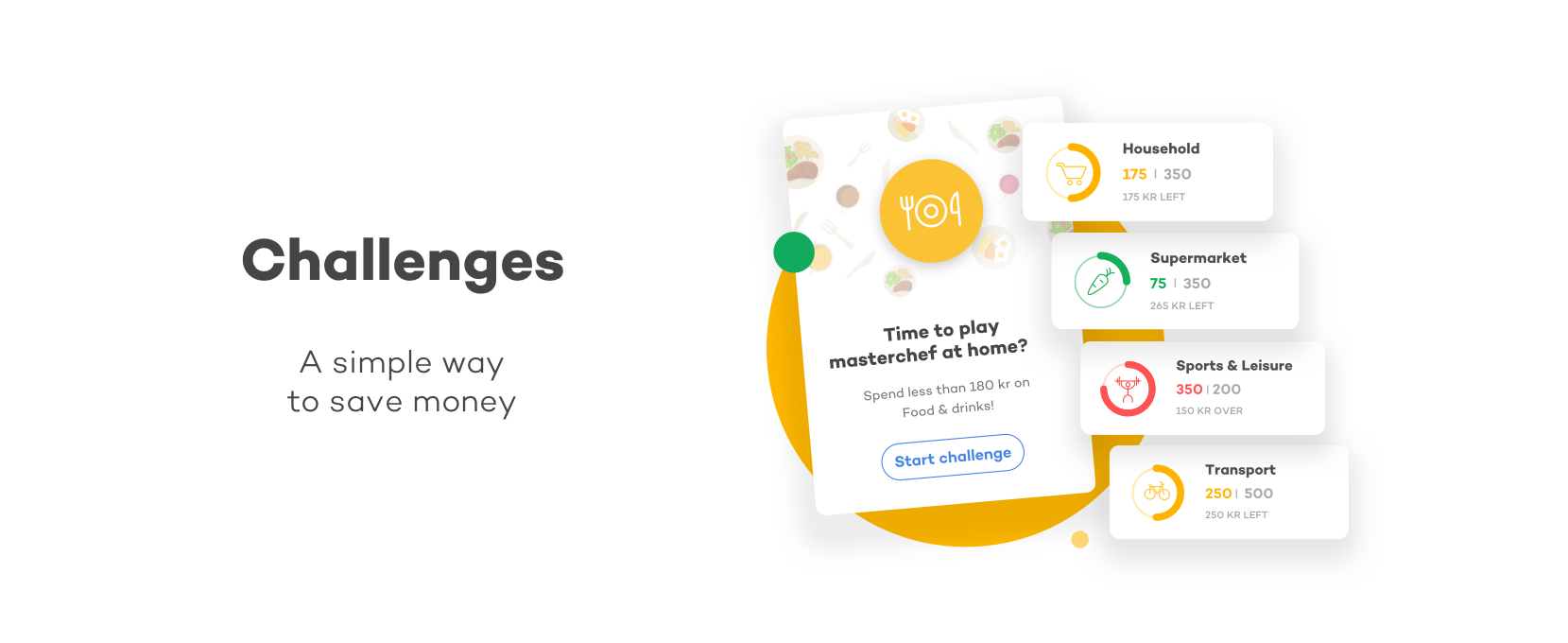

“Someone recommended me to test the challenges on Spiir and I must highlight this part! When you are using Spiir, you can pick a challenge you want to do for a period. Spiir suggests some challenges for you, i.e. to spend less than 100 NOK on fast food a week.

If you don’t like the suggestions, you can create a challenge of your own. This can help you to quit habits and make you more aware of how you can save money. I love these challenges because they are so motivating!” says Miriam.

Miriams’ top 3 financial tips

Before we wrapped up this interview, we asked Miriam to give us her top 3 tips on saving money:

“My best tips are:

- Set goals. What do you want to save money for? A new apartment? A trip to Hawaii? When you set a goal, it becomes easier for you to stick with it.

- Think about what you need versus what you want. We spend so much money on clothes thinking we “need” everything when in reality we just “want” it. Thinking about this can help you save a lot of money!

- Find your everyday savings! Pack a lunch or bring coffee with you when you go to work/campus. It doesn’t seem like a lot of money but spending 60 NOK on lunch each day costs you 14.400 NOK a year!”

Ready to try Spiir?

Join +390,000 happy users today – Spiir gives you an automatic overview of your finances and helps you manage your money with ease 💰

Understand your spending habits on a whole new level with fun insights, top 3 spending categories and much more. You can even save money with fun Challenges that helps you cut back on things like groceries, shopping or other expenses 👉Download Spiir 📱

Releated Posts

Saving hacks, Spending habits

What makes Spiir special? 9 features that have helped +400.000 people manage their finances

What makes Spiir special? Read about our 9 unique features, which make it easier for you to master your finances.

Big news: Spiir, a part of Aiia A/S, is joining Mastercard

Big news! Spiir, a part of Aiia A/S, is joining Mastercard. Read more about it here 🥳

Spending habits, Speakers' Corner

Finnish money experts: This is how you learn to achieve your long-term dreams

A trip around the world? Down payment for a house? Learn to achieve your long-term dreams 🙌